Conquer new horizons with market-leading payment technology

Have your own payment gateway with multi-acquirer and multi-bank, split payments, anti-chargeback and anti-fraud, with our payment orchestration with API integration, with the expertise of those behind the country's largest fintechs.

A totally unique system

A totally unique system

The complete solution for your business

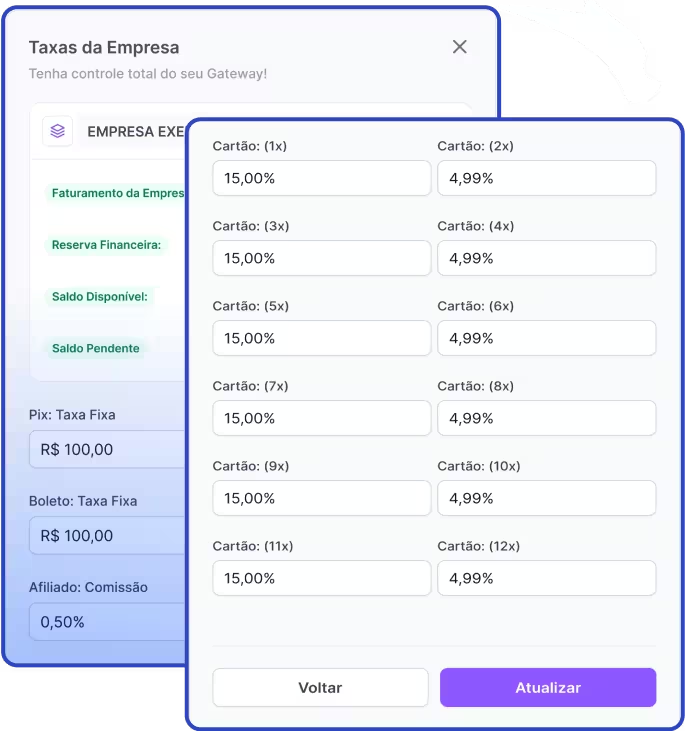

Personalization, automation and advanced analytics to increase profits. branched transactions with anti-chargeback for all business models

Gateway white label:

Adapt the platform to your specific needs for a totally unique and integrated experience.

Split payments:

Debit transaction amounts between different accounts and their partners in a fully automated way.

Higher profits:

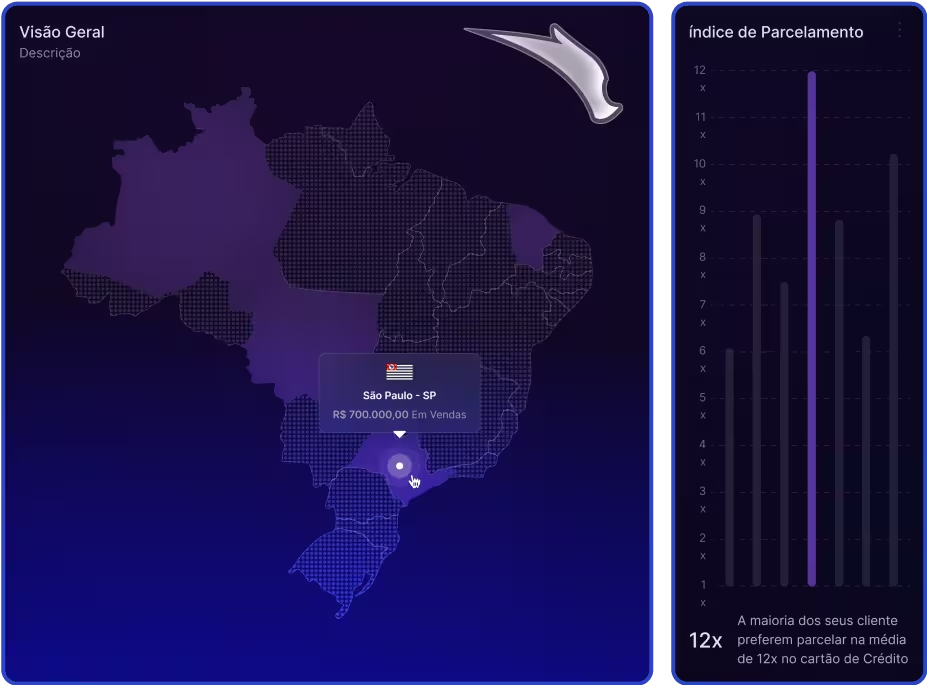

Use our advanced analysis tools to understand customer behavior and make strategic decisions for your customers.

A complete ecosystem for ambitious people

Have your own payment gateway with multi-acquirer and multi-bank, split payments, anti-chargeback and anti-fraud, with our payment orchestration with API integration, with the expertise of those behind the country's largest fintechs.

A robust structure

Stamp your brand, your logo and have your own fintech integrated with the best payment orchestration solutions, anti-chargeback and anti-fraud policy with the best technologies on the market from start to finish with Hydra quality!

+R$ 250

MILLIONS

Volume traded.

+R$ 3

MILLIONS

Paid transactions.

PAYMENT PROCESSORS.

Intelligent orchestration with multi-acquirer and the best approval rate on the market

ACQUIRERS AND PLATFORMS

For integration with your favorite optimization tools.

Advanced metrics analysis

Total management of your system

Your gateway with multiple layers of security.

Ensure security by offering a state-of-the-art gateway. Protect your data with our unbreakable security, specially developed for small, medium and large companies.

Data protected under lock and key

All information is encrypted using the most advanced technologies, guaranteeing the confidentiality and integrity of data at every stage of the transaction.

Multi-layered authentication

Your gateway will offer multiple layers of authentication to verify the identity of customers and prevent fraud.

Constant protection, day and night

Get systems that monitor transactions in real time, detecting and blocking suspicious activity to ensure security.

Want to know why our customers love Hydra Payments?

A totally unique system, with the expertise of those behind the country's largest fintechs

Frequently asked questions

Do you have any questions?

Contact our support team at

WhatsApp +55 (61) 98224-6727

[email protected]

1. Are there any regulations for payment gateways?

Yes, in Brazil, it is not necessary to become a sub-acquirer or acquirer in order to operate a payment gateway. However, it is essential to ensure compliance with the General Data Protection Act (LGPD) and other local laws.

2. How do taxes work for payment gateways?

You must issue invoices for the commissions you receive, as you act as a financial intermediary. Consult an accountant to ensure compliance with tax obligations.

3. What are the advantages of using a payment gateway?

A payment gateway offers advanced security, high profitability, and simplicity with low complexity and few configurations. What's more, its implementation can be quick, usually starting within a week.

4. Do I need a large team to manage a payment gateway?

No, a small, well-trained team can efficiently manage a payment gateway with a low initial cost.

5. What is the process of integrating a payment gateway with my online store?

Integration involves setting up the gateway API on your e-commerce platform. Most gateways provide documentation and support to facilitate this process.

6. What are the costs associated with a payment gateway?

Costs include installation, transaction and monthly maintenance fees. Check the contract details to understand all the fees involved.